ACER’s quarterly monitoring shows European gas markets stabilising amid ongoing challenges

ACER’s quarterly monitoring shows European gas markets stabilising amid ongoing challenges

What is it about?

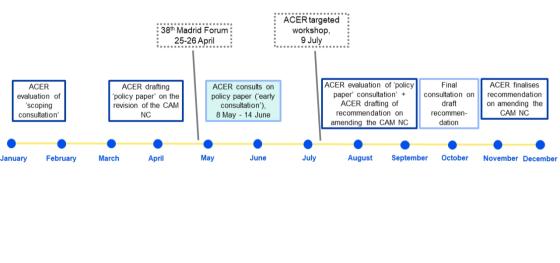

Today, ACER releases its second quarterly review of key developments in European gas wholesale markets as part of its 2024 Market Monitoring Report (MMR). The first publication was issued in March 2024.

This report highlights the main trends in Europe’s gas markets in the first half of 2024 and identifies upcoming challenges for Europe arising from global developments (flows via Ukraine, global LNG markets etc.).

What gas market trends did ACER monitoring find?

The report finds volatile prices and supply changes in European gas markets in the first half of 2024:

- Gas prices: at the end of Q1, European gas wholesale prices fell to levels not seen since before the energy crisis but increased in Q2 as markets re-focused on supply risks, including a tighter global Liquefied Natural Gas (LNG) market.

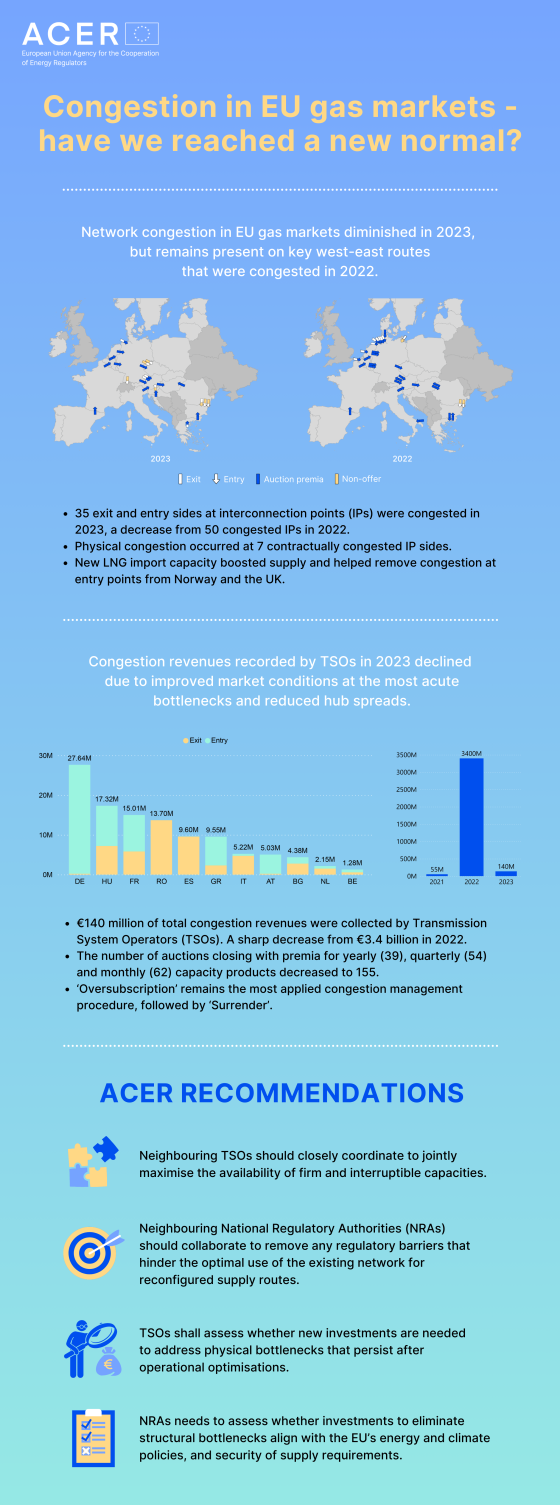

- Price integration has not yet returned to pre-crisis levels, in part due to increased transportation costs. No critical network congestion in Europe’s gas market in the first half of 2024.

- Pipeline and LNG supply: gas pipeline supply to the EU was stable. LNG remained key for EU supply.

- Gas demand fell: in the first half of 2024, gas-fired power generation in the EU decreased by 16% compared to the same period last year.

- Gas storage: In Q2 2024, the EU injected 41 TWh less gas into storage compared to Q2 2023. Despite the slower rate, storages are on course to reach the mandated filling level of 90% by 1 November. The storage level reached in Q2 2024 is one of the highest in the past five summers.

What challenges lie ahead?

- The transportation agreement for Russian gas through Ukraine expires by the end of 2024, and its renewal is unlikely. Landlocked Central European countries will need alternative supply routes, making cross-border trade essential for affordable gas.

- Hurricane season in the Atlantic (from June to October) could affect LNG production and transportation in the Gulf of Mexico, reducing global LNG supply and tightening European gas balances.

- Any delays in concluding the scheduled maintenance of Norwegian upstream gas assets in September could trigger price volatility.

- If gas withdrawals significantly exceed those of the past two winters, EU buyers may need to increase their competitiveness in the LNG markets to replenish stocks in 2025, potentially impacting wholesale prices. Weather conditions will play a key role in exposing or mitigating these risks.

- Several LNG production projects are nearing completion, with first cargoes expected in 2025, which could help stabilise gas prices. Significant additional LNG volumes are anticipated from 2026 onwards, as several large projects are scheduled to come online.

ACER will continue to closely monitor trends in the European gas markets that could lead to short-term volatility for European energy markets. The next update on the European gas wholesale markets will be published in October 2024.