About REMIT

About REMIT

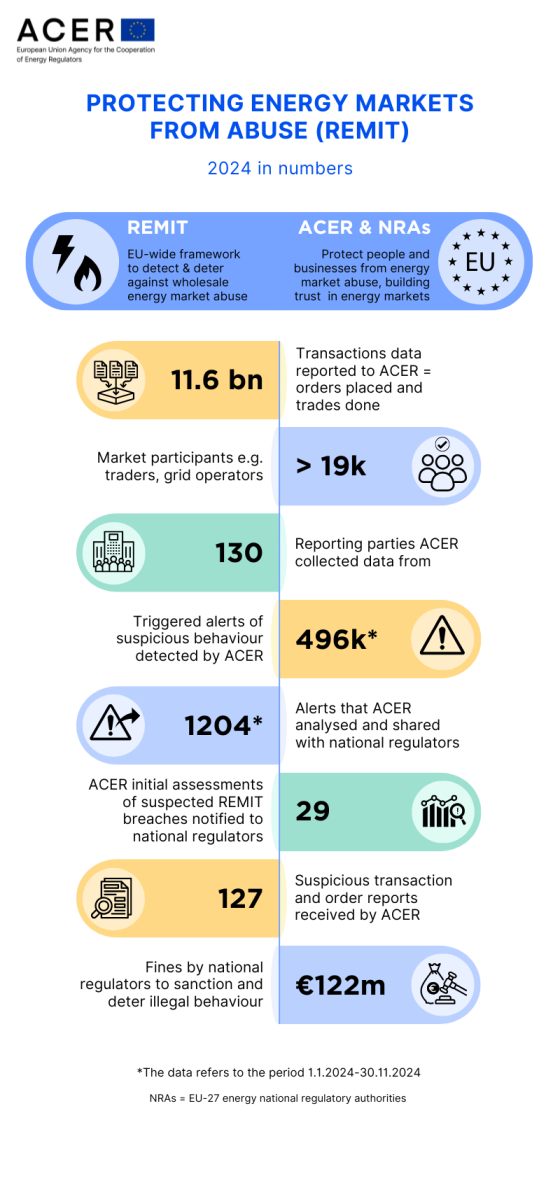

ACER (the EU Agency) and the national (energy) regulatory authorities protect energy markets from abuse, building trust that energy markets work well for businesses and citizens. It is important that wholesale energy markets function well and that prices are determined in a fair way.

The Regulation on Wholesale Energy Market Integrity and Transparency (REMIT) came into force in 2011 to support open and fair competition in the European wholesale energy markets.

The revised REMIT (which takes effect from 7 May 2024) introduces new measures to better protect the EU citizens and businesses from energy market abuse. How?

- The revised REMIT brings a closer alignment of the EU rules on transparency and integrity of energy markets with those in the financial markets.

- The scope of REMIT is expanded. For example, it now also covers energy (electricity and gas) storage, and the market abuse provisions under REMIT also apply to financial instruments.

- ACER regular surveillance scope is expanded to EU platforms covering electricity balancing markets and more information is provided about algorithmic trading.

- The REMIT reform creates a new setting for investigations and enforcement. ACER has been granted an investigatory mandate in cross-border cases affecting two or more Member States. This mandate complements national regulators’ investigatory authority, with ACER and NRAs working closely together. See ACER’s Rules of Procedure on how such cross-border investigations are conducted.

- Enforcement continues to be at national level. The power to impose fines for infringements of the REMIT prohibitions or the substantive obligations included in the regulation will remain in the hands of the Member States. ACER’s enforcement powers are limited to ACER being able to carry out our investigations or compliance with our requests for information e.g. if a party inhibits our onsite inspection or fails to provide the requested information then ACER can impose a fine. ACER has also been tasked with adopting decisions to approve the authorisations and the withdrawal of authorisations of Inside Information Platforms (IIPs) and Registered Reporting Mechanisms (RRMs).

- ‘Inside Information Platforms (IPPs)’ are internet-based platforms where market participants can publish inside information. With the revised REMIT it will be mandatory to use IIPs for the disclosure of inside information.

- ‘Registered Reporting Mechanisms (RRMs)’ are entities that have the authority to submit data and transaction information to ACER on their own behalf (their own data) and/or report data of other market participants (in which case they provide a service). There are about 140 RRMs (see the list of RRMs). Authorisation is only available to RRMs that were founded within the European Union.

- ACER will also develop and operate a platform serving as a sector-specific electronic access point for inside information that is disclosed, as well as a digital reference centre of information on EU wholesale energy market data.

See the ACER Open letter which addresses questions from stakeholders to help them comply with their reporting obligations under ‘Revised REMIT’.

About REMIT

How to ensure market transparency and integrity?

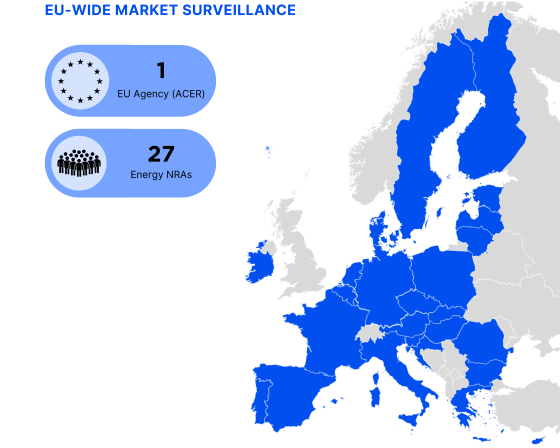

Multiple actors cooperate and contribute in ensuring and delivering the transparency and integrity of wholesale energy market under REMIT. These include ACER, national regulatory authorities (NRAs), persons professionally arranging transactions, market participants, or any person observing potential market abuse.

All these actors can notify a potential REMIT breach observed either in the analysis of REMIT data, continuous market monitoring, or in their daily practice.

Anyone can notify suspicious behaviour under REMIT through the notification platform.

About REMIT

What’s the role of ACER?

ACER is responsible for collecting all relevant trading data, monitoring wholesale energy markets and coordinating follow-ups on potential REMIT breaches to ensure consistency at European level.

While REMIT enforcement remains the responsibility of national regulatory authorities (NRAs), the revised Regulation (2024) has expanded ACER’s role to include investigating market abuse cases that affect two or more EU countries. See ACER’s Rules of Procedure on how these cross-border investigations are carried out.

Cycle of REMIT activities (under ACER and NRAs):

- Define data collection standards

- Collect REMIT Data

- Assess

- Detect

- Notify

- Coordinate

- Investigate

- Penalise

- Deter