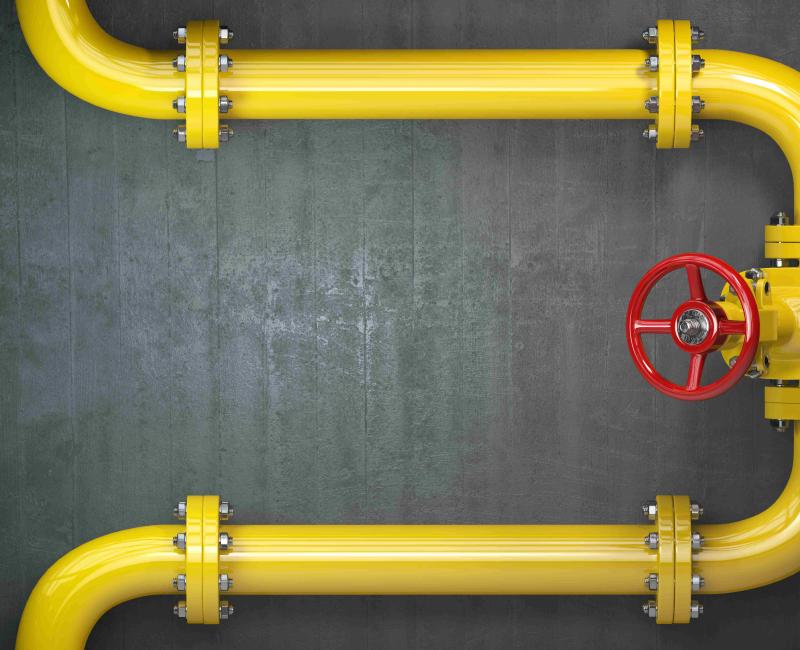

ACER scrutinises the bi-directional gas flow decision at the EUGAL interconnection between Czech Republic and Germany

ACER scrutinises the bi-directional gas flow decision at the EUGAL interconnection between Czech Republic and Germany

What is it about?

ACER has released its Opinion on a recent decision concerning the bi-directional gas flow capacity at the cross-border Interconnection Point (IP) ‘Deutschneudorf EUGAL’ between Germany and the Czech Republic.

What is bi-directional gas flow capacity?

Under the European Security of Gas Supply Regulation, Transmission System Operators (TSOs) must establish permanent physical capacity for gas transport in both directions (bi-directional capacity) at all IPs between Member States. However, temporary exemptions can be granted following a detailed assessment and consultations with stakeholders, other Member States, and the European Commission.

ACER’s assessment

ACER reviewed the decision by Bundesnetzagentur, the German National Regulatory Authority (NRA), which was taken in coordination with the Czech Ministry of Industry and Trade. The decision accepts the German TSO’s proposal, which claims that the obligation for bi-directional capacity at the EUGAL IP has already been fulfilled. It concludes that both countries meet the necessary infrastructure standards for securing gas supply and that there is no need for additional capacities from the Czech Republic to Germany.

While ACER considers that the decision complies with most of the Regulation requirements, it identified two missing elements:

- a feasibility study; and

- a cost-benefit analysis (CBA).

Additionally, the TSO proposal and the decision state that the need for an exemption to maintain bi-directional gas flow capacity at the ‘Deutschneudorf EUGAL’ IP is no longer necessary, as bi-directional gas flow capacity could be ensured during a gas supply crisis scenario. However, ACER notes that no significant investments or capacity upgrades took place at this IP between 2020 and 2024.

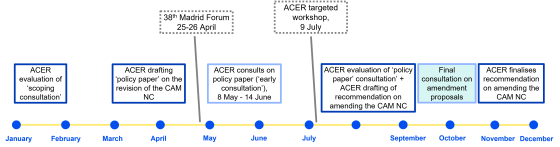

What are the next steps?

ACER has submitted its Opinion to the relevant authorities of Germany and the Czech Republic, as well as to the European Commission for further consideration. The Commission may choose to either raise no objections to the decision or request modifications to it.