Gas factsheet

Gas factsheet

Key facts about gas in the EU

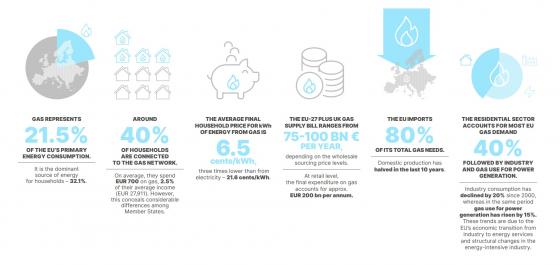

- Gas represents 21.5% of EU’s primary energy consumption. It is the dominant source of energy for households (32.1%).

- Around 40% of households are connected to the gas network. On average, they spend EUR 700 on gas, 2.5% of their average income (EUR 27,911). However, this conceals considerable differences among Member States.

- The average final household price for kWh of energy from gas is 6.5 cents/kWh, three times lower than from electricity (21.6 cents/kWh).

- The EU-27 plus UK gas supply bill ranges from EUR 75-100 bn per year, depending on the wholesale sourcing price levels. At retail level, the final expenditure on gas accounts for approx. EUR 200 bn per annum.

- The EU imports 80% of its total gas needs. Domestic production has halved in the last 10 years.

- The residential sector accounts for most EU gas demand (40%), followed by industry and gas use for power generation. Industry consumption has declined by 20% since 2000, whereas in the same period gas use for power generation has risen by 15%. These trends are due to the EU’s economic transition from industry to energy services and structural changes in the energy-intensive industry.

Image

Gas factsheet

Key attributes of gas & the internal gas market

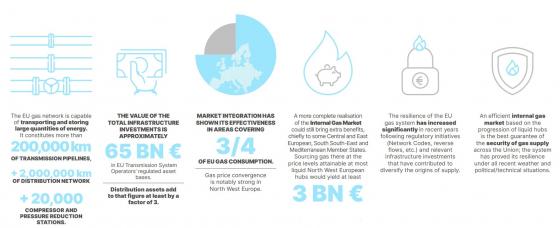

- The EU gas network is capable of transporting and storing large quantities of energy: it constitutes more than 200,000 km of transmission pipelines, over 2 million km of distribution network and over 20,000 compressor and pressure reduction stations.

- The value of the total infrastructure investments is approximately EUR 65 bn in EU Transmission System Operators’ regulated asset bases. Distribution assets add to that figure at least by a factor of 3.

- Market integration has shown its effectiveness in areas covering three-quarters of EU gas consumption. Gas price convergence is notably strong in North West Europe.

- However, a more complete realisation of the Internal Gas Market could still bring extra benefits, chiefly to some Central and East European, South South-East and Mediterranean Member States. Sourcing gas there at the price levels attainable at most liquid North West European hubs would yield at least EUR 3 bn of benefits per year (or 20 to 40 EUR per year to individual household consumers).

- The resilience of the EU gas system has increased significantly in recent years following regulatory initiatives (Network Codes, reverse flows, etc.) and relevant infrastructure investments that have contributed to diversify the origins of supply.

- An efficient internal gas market based on the progression of liquid hubs is the best guarantee of the security of gas supply across the Union; the system has proved its resilience under all recent weather and political/technical situations.

Image

Gas factsheet

The role of gas in a transition phase towards decarbonisation

Image

Image

The European Green Deal aims to fully decarbonize the gas sector by 2050

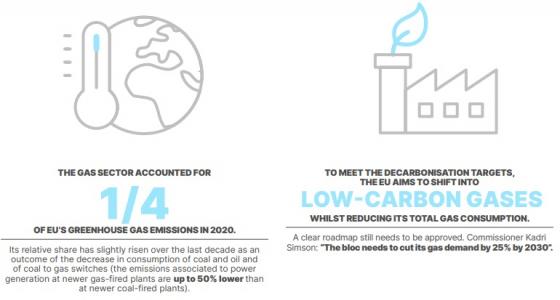

- The gas sector accounted for a quarter of EU’s greenhouse gas emissions in 2020. Its relative share has slightly risen over the last decade as an outcome of the decrease in consumption of coal and oil and of coal to gas switches (the emissions associated to power generation at newer gas-fired plants are up to 50% lower than at newer coal-fired plants).

- To meet the decarbonisation targets, the EU aims to shift into low-carbon gases whilst reducing its total gas consumption. A clear roadmap still needs to be approved. (Commissioner Kadri Simson: “The bloc needs to cut its gas demand by 25% by 2030”).

- The reduction of methane leakages is also imperative. The EU aims to reduce them by 29% compared to 2005 levels by 2030.

Biogas and Hydrogen will play the leading role

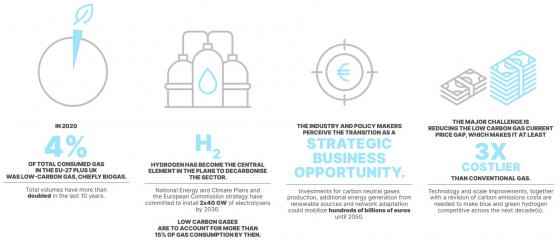

- In 2020 4% of total consumed gas in the EU-27 plus UK was low-carbon gas, chiefly biogas. Total volumes have more than doubled in the last 10 years.

- Hydrogen has become the central element in the plans to decarbonise the sector. National Energy and Climate Plans and the European Commission strategy have committed to install 2x40 GW of electrolysers by 2030. Low carbon gases are to account for more than 15% of gas consumption by then.

- The industry and policy makers perceive the transition as a strategic business opportunity; investments for carbon neutral gases production, additional energy generation from renewable sources and network adaptation could mobilize hundreds of billions of euros until 2050.

- The major challenge is reducing the low carbon gas current price gap, which makes it at least three times costlier than conventional gas. Technology and scale improvements, together with a revision of carbon emissions costs are needed to make blue and green hydrogen competitive across the next decade(s).

Impacts on the sector in the years to come

-

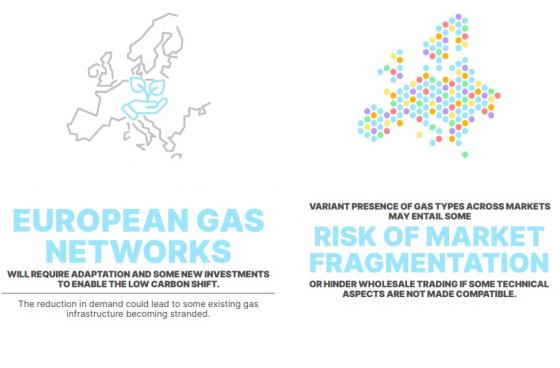

European gas networks will require adaptation and some new investments to enable the low carbon shift. The reduction in demand could lead to some existing gas infrastructure becoming stranded.

- A variant presence of gas types across markets may entail some risk of market fragmentation or hinder wholesale trading if some technical aspects are not made compatible.

Image

Gas factsheet

Gas and the COVID-19 crisis

Image

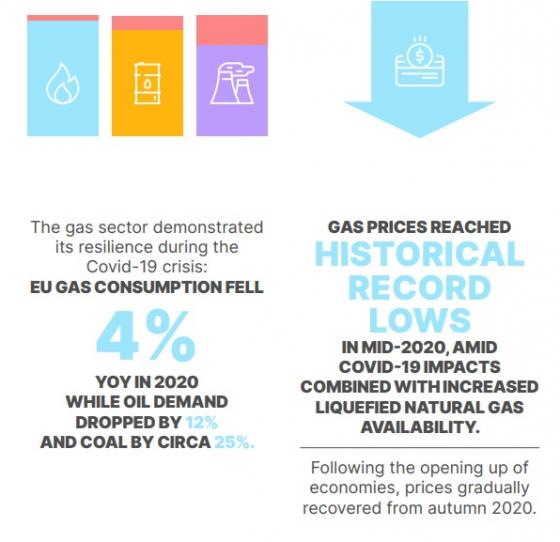

- The gas sector demonstrated its resilience during the Covid-19 crisis: EU gas consumption fell 4% YoY in 2020 while oil demand dropped by 12% and coal by circa 25%.

- Gas prices reached historical record lows in mid-2020, amid Covid-19 impacts combined with increased Liquefied Natural Gas availability. Following the opening up of economies, prices gradually recovered from autumn 2020.