EU gas supply sourcing costs fell to record low in 2020 due mainly to COVID-19 gas demand reductions and record LNG deliveries

EU gas supply sourcing costs fell to record low in 2020 due mainly to COVID-19 gas demand reductions and record LNG deliveries

What is ACER's preliminary assessment of gas supply sourcing costs about?

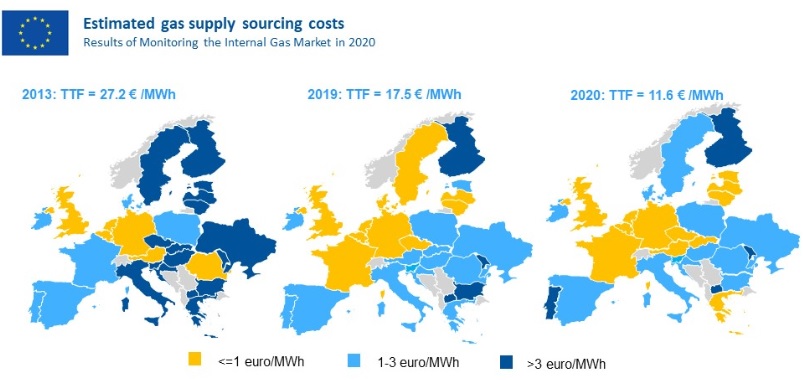

Average gas supply sourcing costs declined in 2020 in most EU Member States and the Energy Community Contracting Parties by more than 4 Euros/MWh year on year, according to today's preliminary assessment of the EU Agency for the Cooperation for Energy Regulators (ACER) and the Energy Community. When comparing gas sourcing costs in 2020 to their average between 2012-2019, prices declined by 8 Euros/MWh.

The assessment measures the average yearly price at which nationwide suppliers can source their wholesale gas. The calculation considers the prices of products traded at the national hubs as well as declared cross-border gas imports and domestically produced gas.

The main drivers of the price decline were the demand reduction caused by COVID-19 and the highest-ever liquefied natural gas (LNG) deliveries registered during the first half of 2020. These resulted in historically low EU hub spot prices in the second quarter of 2020. The decline in the prices of other energy commodities and the above average underground storage stocks at the beginning of the injection season were other contributing factors. Even though hub prices partly recovered from the third quarter, average yearly supply sourcing costs reached their record low since ACER started to assess them in 2012.

Convergence in sourcing prices remained overall robust amongst a majority of Member States, with the largest differences rounding about 3 Euros/MWh. This demonstrates the benefits of the Internal Gas Market. For example, in 2013 sourcing cost spreads of more than 5 Euros/MWh were frequent, implying extra yearly expenditure from 40 to 60 Euros for the average final household consumers in higher costing gas markets. Increased convergence in gas sourcing cost is estimated to have yielded average annual welfare gains in the range of 3 billion Euros for EU gas consumers since 2013.

Source: ACER and Energy Community calculation based on Eurostat Comext, ICIS Heren and National Regulatory Authorities.

Note: Gas sourcing cost within a given Member State vary per shipper and supply period, shaped by the features of the various contracts, hedging strategies as well as distinct supply origins. To infer an average yearly gas supply price, the Agency uses a methodology that considers three main types of sourcing costs (see MMR 2015, Annex 6): i) based on an explicit basket of hub products (in markets with sufficient forward transactional activity), ii) based on declared cross-border imports and iii) based on domestic production prices. The map displays the arithmetic average of all sourcing mechanisms; the report will contain the exact price estimates per supply mechanism.

Despite the impact of COVID-19 on gas demand and the enhanced availability of liquefied gas, the average gas price did not decline uniformly across the EU. This resulted in some price gaps between the Dutch Title Transfer Facility (TTF) hub-based benchmark and the sourcing costs of some Member States. Prices were higher on average at Member States with a higher reliance on long-term supply contracts indexed either to oil or longer-curve' hub products. The highest average sourcing costs were reported in Southern East, Mediterranean and some Central East Member States. All Baltic countries (excluding Finland), and also Greece, reported very price-competitive import prices in 2020. ACER considers that in both cases this is due to the larger relative indexation to hub prompt products in their more recent LNG supply contracts.

Sourcing costs at the Energy Community Contracting Parties were uneven, shaped by the characteristics of the diverse markets. In the majority of them, gas prices continued to be somewhat higher than for the average of EU Member States due to a prevalence of less favourable long-term contracts and more limited upstream supply competition. However for example in Ukraine the price gap have lessened following market reforms that have made import prices more correlated with EU hubs. Ukraine retains also ample cost-competitive domestic gas production.

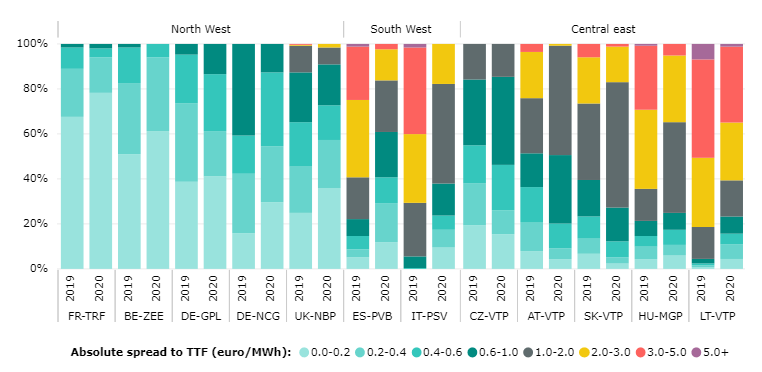

In a related exercise, the upcoming 2020 ACER Gas Wholesale Market Monitoring Report will analyse the level of price convergence of spot products traded at EU hubs. The preliminary results indicate a strong price alignment across the North West European region, where price differences against the TTF benchmark remained below 1 Euro/MWh for almost all trading days, as the figure below illustrates. Hub spreads commonly remain below transportation costs despite the gradual expiration of long-term capacity contracts, which is reducing in turn EU shippers' short-run marginal costs bidding (the Market Monitoring Report will analyse this trend in depth). Record liquefied gas deliveries and flexible North Sea supplies, together with the structural fostering of hub trading at the region, are deemed as limiting price decoupling.

While hub price convergence tends to be stronger at regional level, Central and South Eastern hubs, as well as Mediterranean and Baltic ones, still show some higher spreads when comparing against the TTF benchmark. Those differences arise because of higher transportation tariffs as well as from the specific interplay of marginal supply and opportunity pricing at the individual markets. Nonetheless, overall, spot price alignment increased year on year with lower demand combined with high liquefied gas deliveries and storage stocks. The improvement was notable at the Hungarian, Italian and Spanish hubs. For example, unusually, the Italian hub quoted at a discount to the Austrian hub across the summer months, on the grounds of extra liquefied gas deliveries.

Sourcing costs and hub price individual assessments will be further examined in the next edition of the Gas Wholesale Market Monitoring Report, to be published in July 2021. Furthermore, the report will focus on presenting the results of the ACER Gas Target Model metrics for the year 2020 as well as on assessing the effects of gas network codes implementation. It will include a new chapter identifying the contributions that the gas sector can make to the EU decarbonisation ambitions.