Electricity wholesale markets monitoring in 2020: further action needed on the binding 70% target, barriers, market coupling and security of supply

Electricity wholesale markets monitoring in 2020: further action needed on the binding 70% target, barriers, market coupling and security of supply

Electricity wholesale markets monitoring in 2020: what is new?

The EU Agency for the Cooperation of Energy Regulators (ACER) and the Council of European Energy Regulators (CEER) publish today the new edition of the Electricity Wholesale Markets Volume of the 2020 Market Monitoring Report (MMR).

The MMR presents the main results of monitoring the European internal electricity and gas markets and recommends further actions to foster their integration. It comprises three Volumes, analysing respectively: the Electricity Wholesale Market, the Gas Wholesale Market, and the Energy Retail Market and Consumer Protection.

Historical highs in European energy prices in 2021

This MMR relates to 2020 data. While energy prices decreased in 2020 (in response to the COVID-19 pandemic), wholesale energy prices increased significantly in Q3 2021 (by around 200% since April 2021). Even though various factors have contributed to the high energy prices in Europe, the main driver for the high rise in wholesale electricity prices is the surge in the price of natural gas, caused mainly by a tight global LNG market. See the separate ACER Note on High Energy Prices (October 2021) for insights on the drivers, the impact, and certain policy considerations (such as how to protect vulnerable consumers).

Barriers to efficient price formation and easy market entry and participation: room for improvement

For the first time, this Volume of the MMR includes an assessment of barriers to price formation, as well as to entry and participation of new and small market players. ACER analysed eleven potential barriers and found they exist, to varying degrees, in most of the European Member States.

Regarding efficient price formation, a number of issues stand out as barriers, including insufficient cross-zonal capacity and liquidity. The report identifies several main barriers affecting new and small players. These include:

-

Lack of a legal framework to enable entry and participation in the various market segments.

-

Stringent requirements, e.g. related to prequalification or aggregation, hindering participation in balancing markets.

-

Insufficient retail competition or incentives for consumers to participate more actively.

The report concludes that significant room for improvement can be found by removing wholesale price restrictions, reviewing requirements related to prequalification and aggregation, and urgently finalising the transposition of the Electricity Directive.

COVID-19 and market integration: progress despite the pandemic

The report underlines the drop in demand (annual decrease of 4.1 % compared to 2019) related to the pandemic in the first half of 2020, which exacerbated the decrease in electricity prices observed in the preceding year.

For the first time, renewable energy sources generated more electricity than fossil fuels.

In this context, Member States’ efforts towards market integration continued; particularly in the integration of the EU intraday markets (continuous intraday volumes increased by nearly 32% in 2020). As a consequence of the day-ahead markets’ integration, the level of efficiency in the use of cross-zonal capacity (87%) scored the highest across all short-term timeframes in 2020.

Interruptibility schemes: suggestion of a market-based approach

Interruptibility schemes refer to national programmes dedicated to demand-side response, organised by transmission system operators (TSOs) for temporary load interruption or reduction. For the first time, the report includes an assessment on interruptibility schemes services, identifying four of them: adequacy, balancing, congestion management and contingency reserves. ACER promotes a market-based approach in their usage to increase their efficiency in fostering security of the European electricity supply.

Our recommendations: market coupling, 70% target, barriers and adequacy

ACER and CEER reiterate their recommendation to:

-

Finalise the implementation of the single day-ahead and single intraday market coupling

-

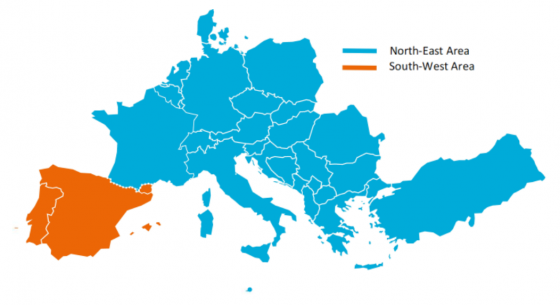

Gradually increase the level of cross-zonal capacity (still far from the 70% binding target)

-

Removing all types of wholesale price restrictions, reviewing requirements related to prequalification and aggregation and urgently finalise the transposition of the Electricity Directive.

-

Establish an appropriate reliability standard, perform sound adequacy assessments at the EU and national level and only adopt capacity mechanisms where resource adequacy issues are forecasted