ACER-ENTSOG joint workshop on Gas Balancing

Bajcsy-Zsilinszky út 52, 1054 Budapest, 17 November, 2015. From 10:00 AM to 5:00 PM

|

In case you have further questions, please contact ACER (Balancing_workshop(at)acer.europa.eu)

Documents

Balancing

Balancing

What is it about?

ACER monitors the effective implementation of the Gas Balancing Network Code and shares its findings in dedicated reports. Most reports used an enhanced review of the country assessments for all or a large subset of balancing zones, focusing on key features of the balancing design.

What are the main findings?

Interim measures have been terminated in most countries and Code implementation has reached a high degree across Europe, with a few exceptions due to structural market limitations.

What does ACER say?

ACER recommends to increase transparency on information provision, also beyond the minimum requirements, and to explore possible efficiency gains (e.g. via balancing zone mergers) to overcome the persisting structural market limitations that do not allow full code implementation.

What is the Balancing Analytical Framework and how it can serve monitoring?

The Balancing Analytical Framework builds on analysing neutrality as a key indicator to understand robust gas accounting and wider regime performance. The Balancing Analytical Framework serves as a quantitative comparison tool, to quantify whether the role of the TSO is residual in balancing or whether network users play an active role, while shedding light on imbalance price differences and neutrality accounting. The framework facilitates comparisons between various balancing regimes in the European Union. The data used in the analysis was provided by ENTSOG and complemented and validated by the Agency.

Workshops

To facilitate the discussion and sharing of best practices on the Code's implementation, a series of workshops was organised. These debates included inputs from the Agency, ENTSOG and representatives of the network user community.

ACER gas balancing dashboard

Check out ACER's gas balancing dashboard & learn how to interact with it.

Related documents

Workshops

-

2018

Eurogas, CEDEC and GEODE collaborated in discussing information provision models and options.2017

Eurogas, CEDEC and GEODE collaborated in discussing information provision models and options.2017 The workshop addressed within-day balancing obligations.

The workshop addressed within-day balancing obligations. The discussions focussed on the Balancing Analytical Framework developed by the Agency, information provision and the importance of linepack information.2016

The discussions focussed on the Balancing Analytical Framework developed by the Agency, information provision and the importance of linepack information.2016 The workshop fostered knowledge sharing across the national implementations of the Code, encouraging the adoption of best practices. The event discussed the importance of planning national implementation, information provision, daily imbalance charges, and neutrality.

The workshop fostered knowledge sharing across the national implementations of the Code, encouraging the adoption of best practices. The event discussed the importance of planning national implementation, information provision, daily imbalance charges, and neutrality.

Archive

Archive

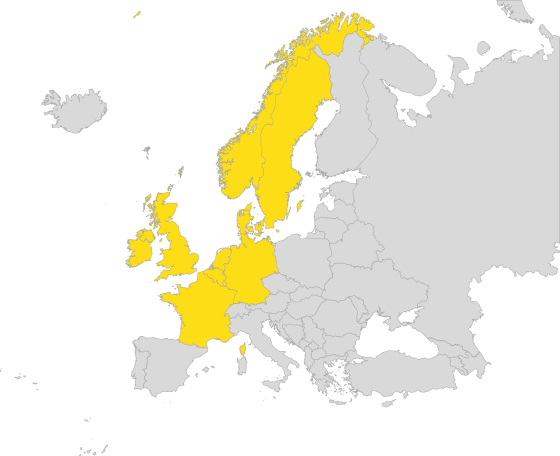

Formerly active region: North West Region

The North West (NW) region has been inactive since 2014. Cooperation continues on a bilateral or multilateral basis, outside the setting of the GRI.

The region was formed by the following countries:

-

Belgium

-

Denmark

-

France

-

Germany

-

Ireland

-

Luxemburg

-

Netherlands

-

Sweden

-

United Kingdom

-

Norway (observer, non-EU country)

The region produces, and consumes, the highest amount of gas in Europe. The region also hosts the most developed gas markets and hubs in the EU.

Archive

↓ See also

South South-East Gas Regional Initiatives

South South-East Gas Regional Initiatives

South South-East Gas Regional Initiatives

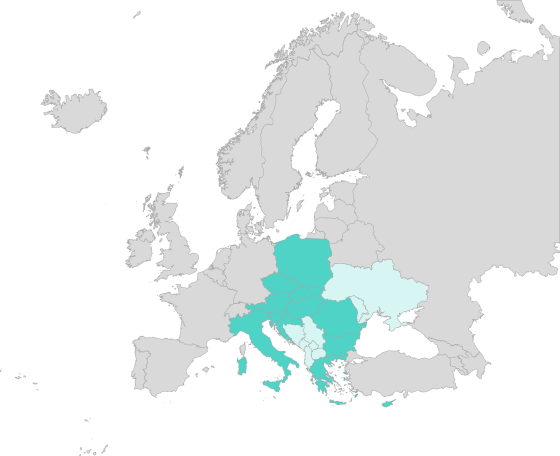

The South South-East (SSE) region includes 20 countries: 12 EU Member States, plus 8 Energy Community Contracting Parties.

The South South-East Gas Regional Initiative is composed of:

-

Austria

-

Bulgaria

-

Croatia

-

Cyprus

-

Czech Republic

-

Greece

-

Hungary

-

Italy

-

Poland

-

Romania

-

Slovakia

-

Slovenia

Participating Energy Community Contracting Parties:

-

Albania

-

Bosnia and Herzegovina

-

Kosovo

-

Former Yugoslav Republic of Macedonia

-

Moldova

-

Montenegro

-

Serbia

-

Ukraine

The region is co-chaired by ERC and E-Control (respectively the North Macedonian and Austrian energy regulator).

The participation of the Energy Community in the GRI SSE is the result of an intensified cooperation started in 2014. Since then, the Energy Community Secretariat has joined the meetings together with the Contracting Parties.

↓ See also

South Gas Regional Initiatives

South Gas Regional Initiatives

Members

The South Gas Regional Initiative is composed of:

-

Spain

-

Portugal

-

France

The Spanish Commission for Markets and Competition (CNMC) leads the Initiative, whose long-term goal is to integrate France, Portugal and Spain into a single regional gas market.

Moving forward the further integration of the Spanish and Portuguese markets, Transmission System Operators have proposed a new algorithm to offer cross-border day-ahead interruptible capacity as bundled product.

Related documents:

↓ See also

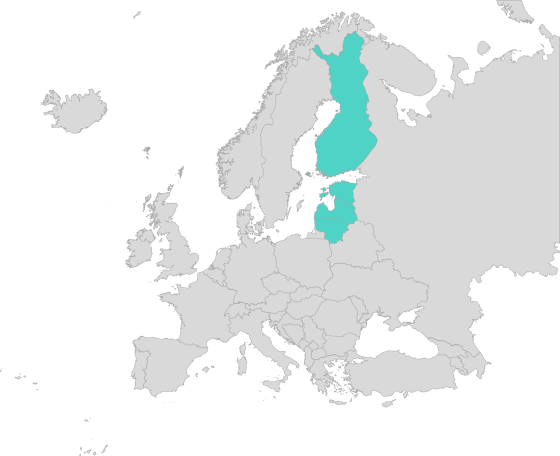

Baltic Regional Gas Market Coordination Group

Baltic Regional Gas Market Coordination Group

Members

The Baltic Regional Gas Market Coordination Group is composed of:

-

Finland

-

Estonia

-

Latvia

-

Lithuania

Baltic Regional Gas Market Coordination Group

A brief historic introduction

The first Regional Gas Market Coordination Group (RGMCG) Action Plan began on 2017 with the implementation of the implicit capacity allocation of the interconnection points between Latvia-Lithuania and Estonia-Latvia. It provided the organised market place where gas could be easily traded cross-border, while at the same time minimising the administrative burden of potentially having third party access (TPA) and balancing agreements between Transmission System Operators (TSOs).

In 2018, the tariff model and inter-TSO compensation (ITC) mechanism for the common Baltic-Finnish market was created, resulting in a stepwise integration approach.

The NRAs of Finland, Estonia and Latvia (FinEstLat) agreed to strengthen their cooperation by creating the FinEstLat market, which became operational on 1 January 2020.

Baltic Regional Gas Market Coordination Group

The FinEstLat system

The FinEstLat single natural gas transmission entry-exit system, also called the 'FinEstLat system', has specific characteristics.

The NRAs have amended the methodologies for calculating the transmission tariffs and approved the tariff scheme, which became applicable as of 1 January 2020. ACER published its analyses of the consultation documents of the Estonian, Latvian, Lithuanian and Finnish reference price methodologies.

Two balancing areas are set up in the FinEstLat system, considering the different level of market maturity in the FinEstLat countries: the common Estonian-Latvian balancing zone and the Finnish balancing zone.

The Regional Gas Market Coordination Group (RGMCG) continues working on a four-country market model, including Lithuania into the regional market.

Following the Roadmap approved in early 2020:

- In March 2020: the Common Regulations for the Use of Natural Gas Transmission System were amended eliminating the inconsistencies that arose during the first months of operating Estonia-Latvia common balancing zone.

- In April-August 2020: external analysis was carried out by Artelys to support a four-country entry tariff area and to design and justify an ITC-model for the four countries that is compliant with all the requirements.

- In May-August 2020: the TSOs jointly conducted an analysis for further integration options and concluded that full market integration should be decided upon only after operational efficiency is significantly improved (internal congestion eliminated), i.e. after 2024 when PCI “Enhancement of Latvia-Lithuania interconnection” is completed.

- In August 2020: the region started to develop the Solidarity agreement based on the Regulation safeguarding the security of gas supply.

- In October 2020: a Memorandum of understanding was signed between the four NRAs to facilitate cooperation, coordination and the creation of the Baltic-Finnish market. A Working Group with the four NRAs was also established.

- In December 2020: the regional TSOs scrutinized the benefits of a common system for issuing and trading guarantees of origin for green gases.

Gas Regional Work Plans

Gas Regional Work Plans

Gas Regional Work Plans

Following the mandate of the European Commission, the gas regions elaborated regional Work Plans. These outline the main projects and activities to be developed at regional level and serve as the main implementation reference. All projects clearly indicate and plan the deliverables, the deadlines, and responsible parties involved.

The currently adopted Work Plan of the South region focuses on:

- Infrastructure

- Market integration

- Decarbonisation

The currently adopted Work Plan of the South South East (SEE) region focuses on:

- Decarbonisation package

- Survey on gas quality

- Survey on gas storage and LNG

The North-West region has been inactive since 2014.

Whenever needed, the Agency provides guidance and coordinates the updates of the Work Plans, suggesting an effective and coherent planning.

Related documents

↓ See also

Gas Regional Initiatives

Gas Regional Initiatives

Bringing market participants together to test solutions and develop best practices

The Gas Regional Initiatives (GRIs) bring market participants together to test solutions for cross-border issues and to develop pilot projects that can be exported to other regions.

The European internal gas market has been divided in four main regions:

-

South GRI

-

South South-East GRI

-

North-West (currently inactive)

-

Regional Gas Market Coordination Group (Baltic Region) (informally joined the initiative in 2018)

Gas Regional Initiatives

Different fora for stakeholders' enagagement

The Initiatives have contributed to noticeable developments in different areas such as capacity allocation, infrastructure development and market integration.

Progresses were possible thanks to effective stakeholders' engagement ensured in different fora:

• Regional Coordination Committee (RCC)

Composed by all NRAs of the region, it coordinates, facilitates and drives forward the regional priority projects. The European Commission and national governments may provide useful input to identify and solve specific issues.

• Implementation Group (IG)

Includes the relevant infrastructure operators (transmission systems, interconnectors, LNG and storage facilities) and provides a technical framework for implementing effective solutions.

• Stakeholders Group (SG)

All other key market participants and consumers are brought together in each region to engage in the discussions.

The Regional Initiatives developed regional Work Plans and cross-regional Roadmaps (in cooperation with ENTSOG), in order to promote the implementation of the Network Codes and market integration.

Capacity allocation

Capacity allocation

What is capacity allocation?

ACER monitors the effective implementation of the Capacity Allocation Mechanisms Network Code and shares its findings in a dedicated report.

Capacity allocation provides mechanisms to obtain capacity products from transmission system operators. It is usually underpinned with a capacity contract between the network user and the network operator.

Capacity allocation

Why is capacity allocation important?

Previous capacity allocation methods did not provide equal and transparent access to potential entrants to the capacity markets, hindering competition.

Capacity allocation

What does ACER say?

Equal and transparent access to transmission capacity in the EU is not a major obstacle anymore. The progressive reduction of the old capacity contracts and their gradual replacement with new ones addressed most of the existing constraints.

↓ See also

Congestion Management

Congestion Management

ACER monitors the effective implementation of the Congestion Management Procedures Guidelines and shares its findings in specific reports. ACER also reports on an annual basis on the status of Congestion at Interconnection Points. On this occasion ACER also checks the transparency of the data published on the ENTSOG Transparency Platform and provides guidance on possible improvements.

What is congestion management?

Contractual congestion occurs when network users cannot obtain the capacity products of their choice because the capacity demand exceeds the offer. It is different from physical congestion, where technical capacity is used to its full extent. Several measures exist to mitigate and prevent contractual congestion.

Why is congestion management important?

Congestion management procedures address congestions and improve market efficiency. National regulatory authorities and transmission system operators can decide on the application of these measures.

What does ACER say?

The Agency reports annually on the status of contractual congestion in EU gas markets and how congestion is managed. Based on the monitoring results, national regulatory authorities can decide on the application of congestion management procedures.

Reports on congestion at interconnection points (IPs):

Congestion Management

Implementation monitoring reports on congestion management procedures

ACER provides analyses and case studies in yearly reports about the national implementations on congestion management procedures, evaluating their effects at European level.

The Agency published its first Implementation Monitoring Report on Gas Congestion Management Procedures in 2015 and provided an update a year later. The Agency found incomplete implementation and limited application of congestion management in both years and has continued to promote the usage of congestion management instruments ever since.