ACER calls for improvements to the proposed Greek gas transmission tariffs

ACER calls for improvements to the proposed Greek gas transmission tariffs

What is it about?

ACER publishes today its report on proposed gas transmission tariffs in Greece.

What is in the report?

ACER assessed the proposed tariff methodology to calculate the natural gas transmission network in addition to the charge used to allocate part of the costs of the Revithousa LNG terminal to users of the Greek gas transmission network.

What are ACER’s main findings?

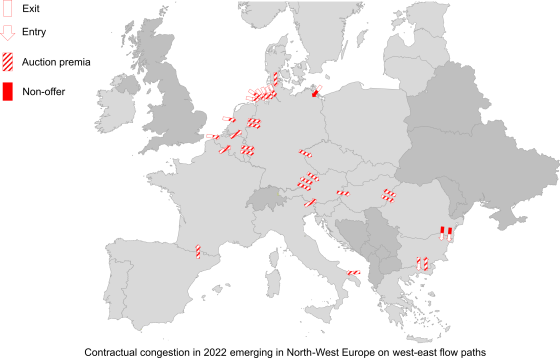

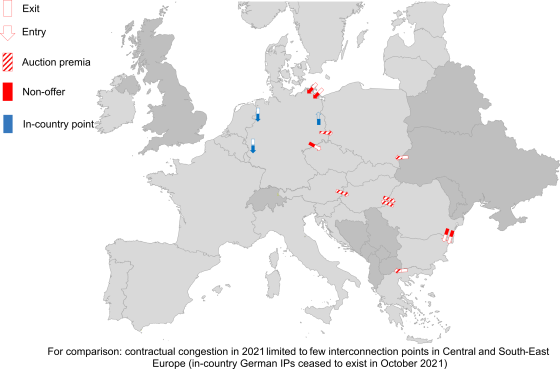

ACER notes that the Greek gas transmission network has seen a significant change in recent years, as a result of the construction of new infrastructure and the changing flow patterns. In the coming years, Greece could become a landing point for LNG to be transported to North Macedonia, Bulgaria and beyond via different interconnection points in the North.

ACER finds that the choice of the postage stamp methodology and the network charge to allocate the costs of the Revithousa LNG terminal should be further substantiated.

ACER recommends to the Greek national regulatory authority, RAE, to assess the possibility to set tariffs based on locational signals in the future. This can provide investment signals for future investments, enabling efficient decisions over the potential expansion of the network.

Access the report on the Greek gas tariffs.

Access all ACER reports on national tariff consultation documents.