Congestion in the EU gas markets: have we reached a new normal?

What is it about?

ACER’s 2024 report finds that congestion progressively diminished in 2023 due to adjustments of gas demand, supply, and flow paths to reduce reliance on Russian gas. However, the repercussions of the gas market crisis remain clear, as price convergence between European gas hubs has not yet reached the pre-crisis levels.

What does congestion mean?

Different types of congestion can occur in gas markets:

- Contractual congestion happens when the capacity of the gas transportation system is fully booked but remains partially unused, with actual gas flows below the technical limit of the gas system. This can prevent other users from accessing the gas network, leading to inefficiencies. Bringing unused capacity back to the market eases contractual congestion.

- Physical congestion occurs when gas flows reach the technical limit of the gas system. If structural bottlenecks happen, a careful assessment must be done on the need for further investment in the gas system, not necessarily in transmission assets. This assessment should be done in line with the EU’s energy and climate policies, ensure security of supply, and mitigate the risk of future asset stranding.

Addressing the most acute congestions by optimising the use of transmission capacities remains a short-term action that can help deal with tight market conditions.

What are the key findings?

The report finds that in 2023:

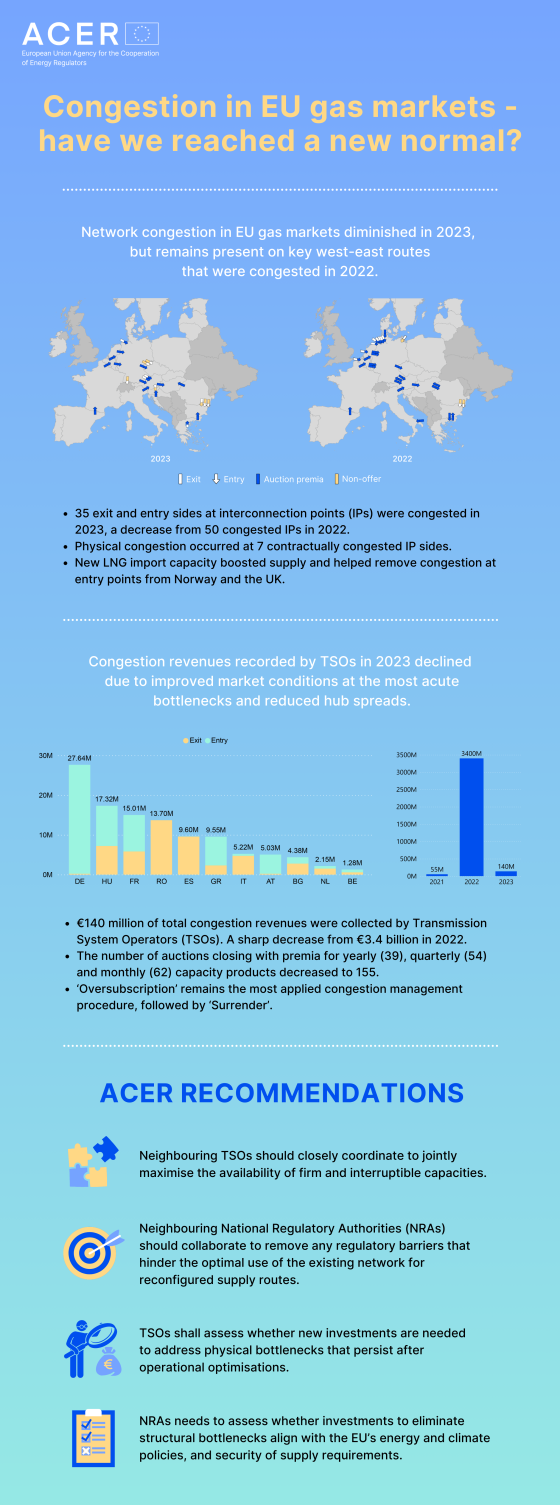

- Congestion diminished but remains present on key west-east routes that allow to reduce the reliance on gas supplies from Russia.

- 35 exit and entry sides at Interconnection Points (IPs) were congested, a decrease from 50 congested IPs in 2022.

- New LNG import capacity boosted supply and helped remove congestion at entry points from Norway and the UK.

- Improved market conditions at the most critical bottlenecks reduced the spreads between hub prices. As a consequence, this lowered the incentive for network users to pay high premiums to acquire capacity to move gas between those hubs.

- Total congestion revenues collected by Transmission System Operators (TSOs) amounted to €140 million, a significant drop from the €3.4 billion generated from capacity auctions in 2022. However, this figure remains high compared to the pre-crisis level of €55 million in 2021.

What does ACER recommend?

- Neighbouring TSOs should closely coordinate to maximise the availability of firm and interruptible capacities.

- Neighbouring National Regulatory Authorities (NRAs) should collaborate to remove any regulatory barriers that hinder the optimal use of the existing network for reconfigured supply routes.

- TSOs shall assess whether new investments are needed to address physical bottlenecks that persist after operational optimisations.

- NRAs need to assess whether investments to eliminate structural bottlenecks align with the EU’s energy and climate policies, and security of supply requirements.

What are the next steps?

ACER reports annually on the status of contractual congestion in the EU gas markets and on how it is managed.

Considering the monitoring results, the NRAs shall decide on the application of congestion management procedures in their own countries.