ACER reiterates its call for stronger transparency in the selection of energy infrastructure projects

ACER reiterates its call for stronger transparency in the selection of energy infrastructure projects

What is it about?

Today, ACER publishes its biennial Opinion on the draft lists of proposed projects of common interest (PCIs) and projects of mutual interest (PMIs) for 2025.

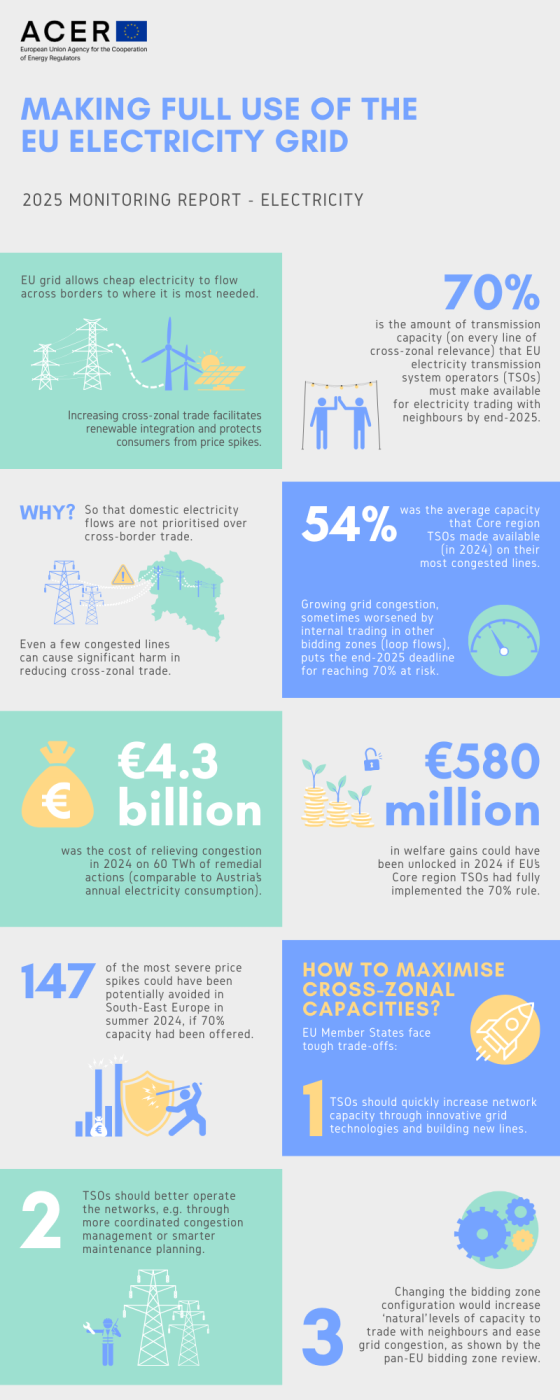

The PCIs/PMIs lists include energy infrastructure projects prioritised at EU level given their impact to significantly enhance the cross-border links among the energy systems of EU countries (and third-party countries in the case of PMIs). These projects can benefit from accelerated permitting procedures, regulatory treatment and funding, as they are identified as key contributors for integrating renewables, boosting cross-border capacity and advancing Europe’s climate and energy goals.

What is the role of ACER?

ACER’s role in the PCIs/PMIs selection process, as defined by the TEN-E Regulation, is to verify that the relevant methodologies and criteria are applied consistently and transparently across regions in the projects’ selection process. A fair and credible process ensures that the most beneficial projects are prioritised in developing trans-European energy infrastructure. ACER’s role is not to give a ‘second opinion’ on the merits of the different projects nor to help decision makers rank such projects for ultimate selection.

What are the key conclusions?

In its Opinion, ACER found:

- Delays in the availability of Ten-Year Network Development Plans (TYNDPs) data and their cost-benefit results, which hindered the projects’ assessment.

- Infrastructure needs have been identified only per Member State, without sufficient identification of capacity needs per border.

- Unclear distinction of monetised and non-monetised benefits in the ranking of projects, reducing clarity on how these are prioritised.

- Lack of justifications of the projects added on top of the formal proposals from the Regional Groups. The Regional Groups are chaired by the European Commission and include representatives from Member States, transmission system operators, project promoters, energy regulators and ACER. Their role is to assess the projects' potential contribution to EU energy priorities.

- Difficulty for regulators, due to insufficient data, to properly assess several hydrogen project candidates, including their underlying benefits, in the lists.

- The draft PCIs/PMIs lists do not clearly distinguish between mature and less mature electricity projects.

As these obstacles may affect the credibility and robustness of the selection process, ACER recommends to:

- Deliver the TYNDP data on time and in good quality for the PCIs/PMIs selection process.

- Introduce an assessment of capacity needs per border per each energy vector, thus improving the needs assessment methodology.

- Clearly distinguish between projects’ monetised and non-monetised benefits.

- Ensure greater transparency in complementary project evaluations, if these can’t be avoided.

- Ensure that the complete set of project data is made available for the national regulatory authorities’ assessment in due time, to allow them to conduct thorough and consistent analyses.

- Introduce maturity criteria for electricity projects to clearly distinguish between mature and less mature projects on the electricity PCIs/PMIs lists. This would ensure transparent prioritisation and allow support for less mature projects when they are ready for construction.

- Consider multiple scenarios, in line with ACER’s Scenario Guidelines, to test the robustness of results.

What are the next steps?

By addressing these issues, the PCIs/PMIs selection process will become more transparent, consistent and credible, ensuring Europe invests in the right infrastructure to meet its energy and climate goals.