ACER’s assessment of 400+ energy emergency measures seeks to inform policy makers going forward

ACER’s assessment of 400+ energy emergency measures seeks to inform policy makers going forward

What is it about?

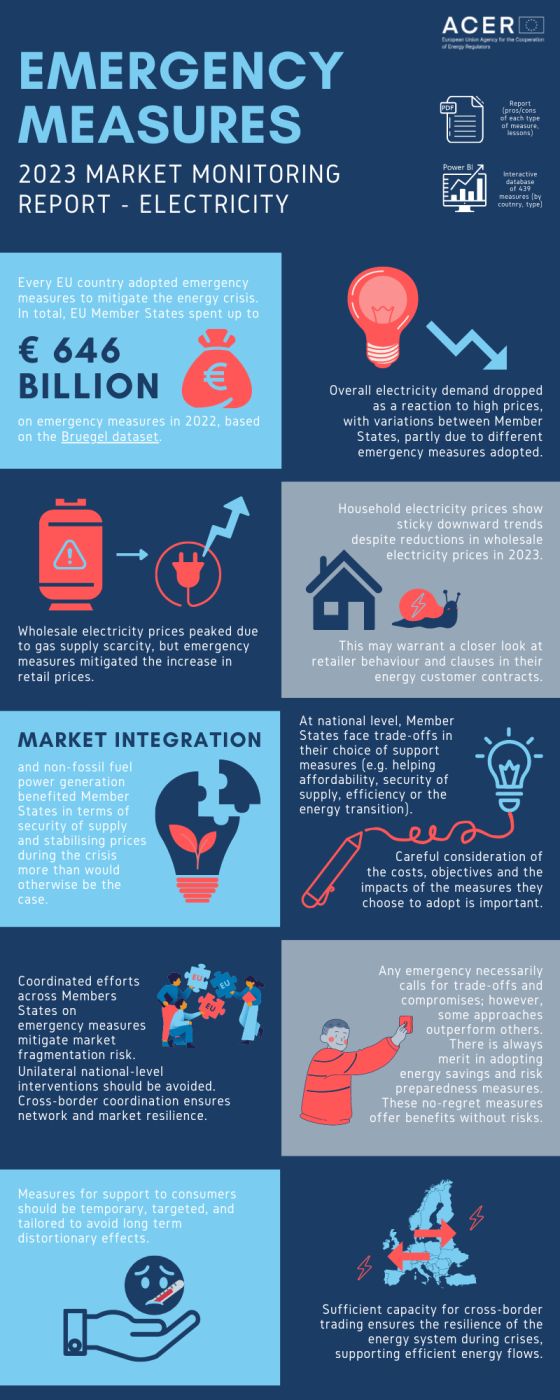

In response to the energy crisis, every EU Member State introduced emergency measures to support their citizens and economy, and to mitigate security of energy supply risks. In March, ACER published an inventory of 400+ measures adopted by Member States.

As part of its series of 2023 Market Monitoring reports, ACER publishes today its assessment of emergency measures in electricity markets.

What is it about?

More than 400 measures were adopted by Member States in response to the energy crisis. Member States had to swiftly respond to complex issues during the crisis, sometimes lacking a comprehensive overview of potential short- and long-term implications of choices made. This report’s objective is not to assign blame but rather to assist decision-makers in making informed choices in similar situations in the future.

The ACER Assessment focuses on lessons learned. This ACER report assesses drawbacks and merits of types of emergency measures against the achievement of 5 regulatory goals, namely how the measures;

- Help consumers in terms of electricity affordability;

- Contribute to security of supply;

- Support energy transition and investment signals;

- Promote energy efficiency and demand response; and

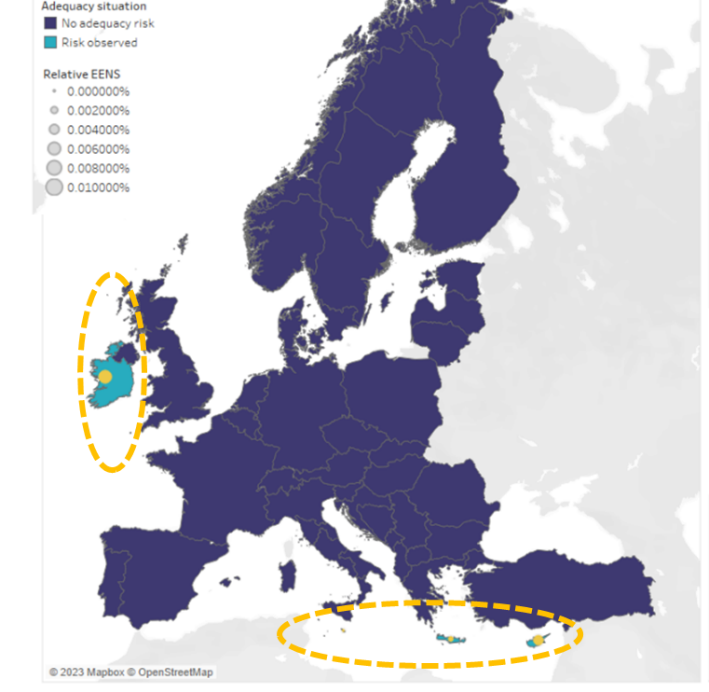

- Contribute to efficient cross-border trading and market integration to benefit European consumers. Market integration allows for the mitigation of price shocks and increases security of supply.

ACER’s assessment of emergency measures is timely:

- As energy and fiscal policy makers consider next steps now to cope with persistent short-term energy challenges;

- With Member States starting to re-evaluate their energy emergency support measures in the context of falling energy prices;

- Given recent calls (by certain EU bodies) for fiscal policy (in the current high inflation environment) to be targeted, tailored and temporary.

Lessons from 2022 can help Member States determine where and when to direct any future energy support measures, to those in need.

What’s next?

Save the date – 6 September 2023 – when ACER will present and discuss the conclusions of the report.

ACER welcomes feedback ahead of the webinar, to be sent to 2023_emergency_measures(at)acer.europa.eu.

Access:

- ACER Assessment of emergency measures in electricity markets – 2023 Market Monitoring Report.

- ACER emergency measures infographic.

- ACER interactive inventory of 439 energy crisis measures adopted by Member States (you can filter by country, type of emergency measure).