year-on-year increase in gas storage injections in Q2 2025, narrowing the stock gap with previous years.

Key developments in European gas wholesale markets - Q2 2025

-

Gas

Gas

2025 Monitoring Report

This report provides insights into European gas wholesale markets during the early months (April to June 2025) of the gas summer season, highlighting main trends in gas supply, demand and market prices.

This analysis helps inform policies aimed at ensuring secure and competitively priced gas.

What trends did ACER monitoring find?

- Prices and volatility: Average European wholesale gas prices fell by more than 20% quarter-on-quarter after a challenging winter period (January to March 2025) marked by high prices. Price volatility decreased but remained relatively high, with the largest fluctuations coinciding with global economic and geopolitical shocks. Regional price differences widened, as some markets (particularly in Central and Eastern Europe) priced at a premium to attract flows from the west.

- LNG imports: EU imports of liquefied natural gas (LNG) increased by more than a third compared with the same period last year. This was supported by competitive prices at EU gas hubs, available capacity at import terminals, stagnant demand in Asia and the ramping up of new liquefaction facilities in the US.

- Pipeline imports: No significant changes were observed in European gas pipeline imports in the second quarter of 2025, apart from those originating from Russia, which declined by circa 45% year-on-year, as contracts for transit via Ukraine lapsed at the end of 2024. Russian gas has since been shipped to the EU only via the TurkStream pipeline, which runs from Russia to the EU via Turkey.

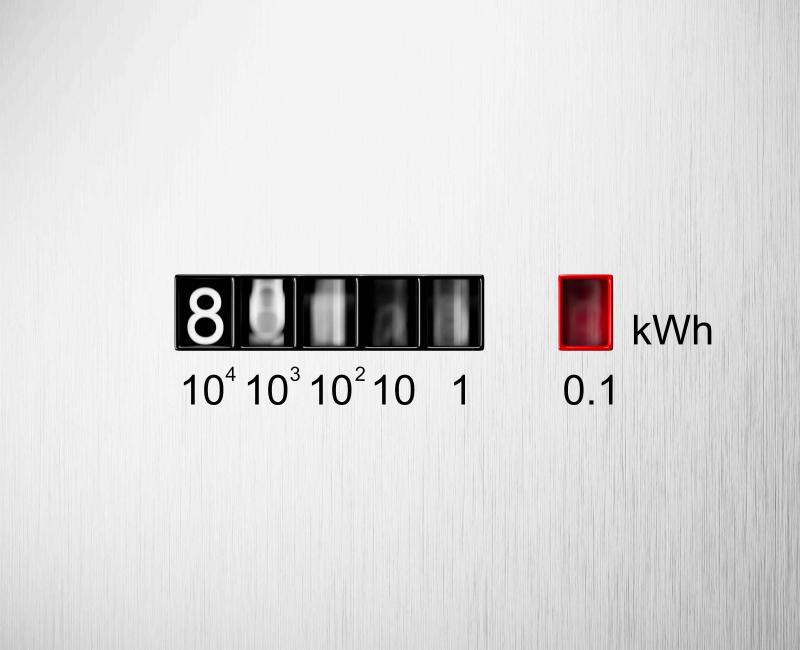

- Gas storage: Storage injections increased by 75 TWh compared with the same quarter in 2024, narrowing the stock gap with previous years. Unlike the comfortable end-of-winter stock levels seen in 2023 and 2024, storages were relatively empty at the end of March 2025 due to a mix of supply and demand factors.

Looking ahead

- EU gas storages are likely to be sufficiently stocked ahead of the 2025/2026 winter, provided that LNG imports and storage injections continue at Q2 levels throughout the remainder of the gas summer season. This would support a relatively comfortable winter outlook.

- However, risks remain in the coming months, as the European storage refilling trajectory could be negatively impacted if one or more of the following events were to occur: extreme weather or draught triggering increased demand (in the EU or other LNG-importing region), outages at key supply sources, or geopolitical instability disrupting supply routes.

- At the same time, an easing in the global LNG market is expected, as new LNG production facilities come online in 2025, 2026 and beyond.

Highlights

-

+75 TWh

-

+35%

year-on-year increase in EU LNG imports, driven by competitive prices and the ramping up of new liquefaction facilities.

-

-45%

drop in Russian pipeline gas to the EU after Ukraine transit expired.

Report

ACER’s report on key developments in European gas markets (Q2 2025):

- analyses key supply trends and price developments;

- assesses LNG imports, pipeline flows and storage dynamics; and

- shows how market fundamentals are evolving ahead of winter 2025/2026.

Additional information

- Access the underlying datasets.