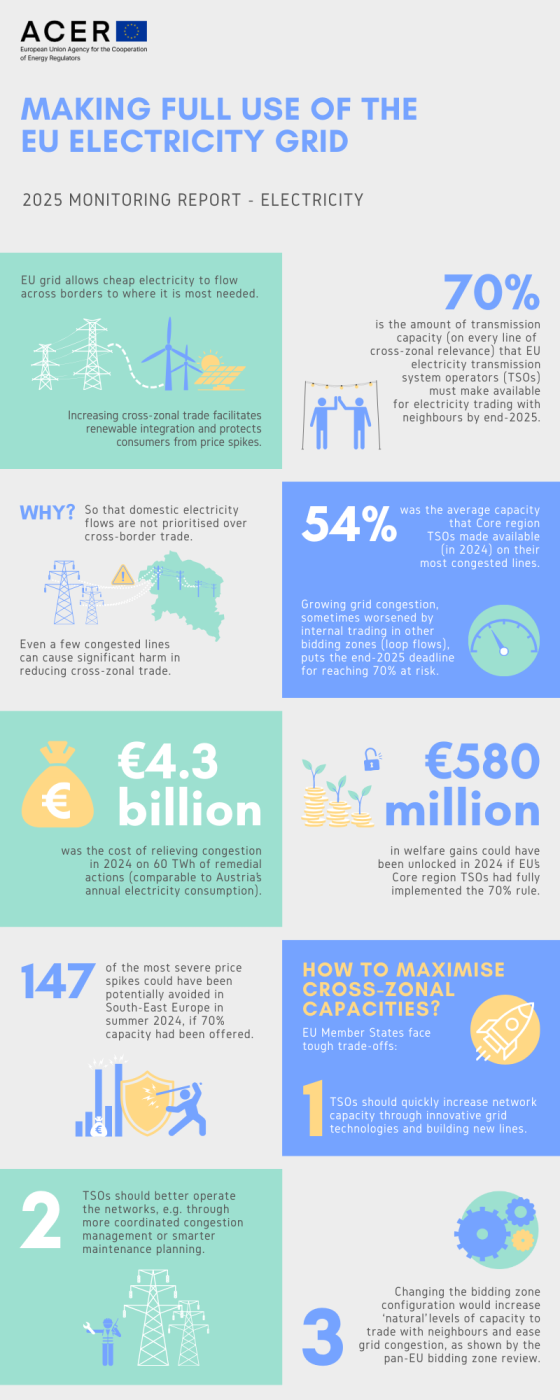

expected welfare gains had TSOs in the Core region made 70% of capacity available for cross-zonal electricity trade in 2024.

ACER to decide on amending the maximum and minimum clearing prices for the European day-ahead and intraday electricity markets

ACER to decide on amending the maximum and minimum clearing prices for the European day-ahead and intraday electricity markets

What is it about?

On 4 August 2025, ACER received two proposals from all nominated electricity market operators (NEMOs) to amend the harmonised maximum and minimum clearing price (HMMCP) methodologies for the European day-ahead and intraday markets, respectively.

What are the methodologies about?

Established under the Capacity Allocation and Congestion Management (CACM) Regulation, the HMMCP methodologies describe the automatic price adjustment mechanisms and how they may be triggered in cases of exceptionally high or low prices in Europe’s electricity day-ahead and intraday markets. They also define the maximum and minimum price limits (the so called ‘maximum and minimum clearing prices’) for the European day-ahead and intraday markets.

Why amend the methodologies?

NEMOs propose to include an additional metric (based on market liquidity) among the conditions for triggering the automatic price adjustment mechanism. The purpose of such inclusion is to avoid the potential triggering of the automatic price adjustment mechanisms in cases of low liquidity in the European day-ahead and intraday markets.

What are the next steps?

ACER expects to decide on the methodologies by February 2026.

Contact information

Interested parties are encouraged to submit comments or questions to ACER-ELE-2025-008@acer.europa.eu by 31 October 2025.

Relevant documents

- All NEMOs proposal to amend the HMMCP methodology for SDAC.

- All NEMOs proposal to amend the HMMCP methodology for SDAC (in track changes).

- All NEMOs proposal to amend the HMMCP methodology for SIDC.

- All NEMOs proposal to amend the HMMCP methodology for SIDC (in track changes).

- Explanatory note - SDAC.

- Explanatory note - SIDC.

Update

Update of 5 February 2026: With its Decisions 02/2026 and 03/2026, ACER approved the proposal.