ACER webinar: Improving EU scenario development to meet future energy needs

ACER recommends flexible and transparent inter-temporal cost allocation to support hydrogen investments

ACER recommends flexible and transparent inter-temporal cost allocation to support hydrogen investments

What is it about?

ACER publishes today its first Recommendation on inter-temporal cost allocation mechanisms for financing hydrogen infrastructure. To ensure the recommendation is well-informed, ACER conducted a public consultation on the topic in spring 2025.

What is inter-temporal cost allocation and why an ACER recommendation?

The EU aims to build a cost-effective hydrogen network to meet its climate goals. However, high infrastructure costs and demand uncertainty pose significant investment challenges, especially in the early stages of market development.

To address this issue, the EU Hydrogen and Decarbonised Gases Regulation (2024) grants Member States the authority to allow hydrogen network operators to recover infrastructure costs gradually over time through inter-temporal cost allocation mechanisms. These aim to ensure a fair and balanced distribution of costs between early and future consumers, ensuring that the former are not disproportionately burdened.

The regulation also assigns new hydrogen-related tasks to ACER, including issuing a recommendation to guide the development and implementation of inter-temporal cost allocation mechanisms. ACER’s Recommendation provides practical advice to support the rollout of hydrogen networks and ensure fair cost-sharing over the long term.

What does ACER recommend?

ACER’s Recommendation identifies key investment risks in hydrogen infrastructure and suggests ways to address them. It offers high-level guidance on designing fair and effective inter-temporal cost allocation mechanisms to support the development of the hydrogen market. ACER also highlights the need for Member States to promptly establish clear hydrogen regulatory frameworks and develop flexible national rules to accommodate the future EU-wide hydrogen network codes.

Given the early stage of the hydrogen market and the lack of established best practices, ACER does not yet propose a single, standardised EU-wide approach. Instead, it calls for:

- Regulatory authorities to:

- ensure that inter-temporal cost allocation mechanisms and national market rules are developed in a coordinated manner;

- strengthen cross-border coordination to avoid market fragmentation in the initial stage of the hydrogen market; and

- establish clear and robust mechanisms that guarantee full cost recovery and fair cost distribution over time to support market growth.

- Network operators and planning bodies to:

- ensure hydrogen network development is based on transparent, data-driven and realistic assumptions.

What are the next steps?

ACER will review and update its Recommendation at least every two years, incorporating more refined guidance as the market evolves. The next publication is planned for 2027.

ACER to decide on amending the intraday cross-zonal gate opening and closure time methodology

ACER to decide on amending the intraday cross-zonal gate opening and closure time methodology

What is it about?

On 2 July 2025, ACER received a proposal from all electricity transmission system operators (TSOs) to amend the methodology for intraday cross-zonal gate opening and closure time.

What is the methodology about?

Established under the Capacity Allocation and Congestion Management (CACM) Regulation, the methodology sets harmonised rules across EU Member States for when electricity trading can begin (gate opening time) and end (gate closure time) in the intraday market.

The intraday market is a short-term market where electricity is bought and sold on the same day as delivery (e.g. a few hours before), after the day-ahead market has closed. It allows participants to adjust their positions based on updated forecasts and balance supply and demand closer to real time.

By coordinating these timings across different bidding zones, the methodology supports market integration and the efficient use of cross-zonal capacity within the European electricity market.

Why amend the methodology?

TSOs propose harmonising the gate closure time at 30 minutes before real-time delivery, replacing the current standard of 60 minutes. The gate opening time would remain unchanged. This amendment aims to align the methodology with the requirements of the Electricity Market Design Reform (2024), which seeks to improve the efficiency of short-term markets.

Shortening the gate closure time is expected to:

- allow market participants to trade electricity closer to real time, giving them more time to respond to last-minute changes in demand and supply;

- support the integration of renewable energy sources and flexibility solutions; and

- help TSOs maintain system balance and security of supply.

What are the next steps?

ACER expects to decide on the amended methodology by 2 January 2026.

Interested parties are encouraged to submit comments or questions to ACER-ELE-2025-007@acer.europa.eu by 26 September 2025.

Future-ready grids: ACER and CEER set out blueprint for distribution planning

Future-ready grids: ACER and CEER set out blueprint for distribution planning

What is it about?

Europe’s clean energy shift is accelerating, and electricity distribution networks must keep pace. From integrating solar panels and electric vehicles to connecting heat pumps and storage, grids need to become more modern, flexible and resilient. To support this, the European Commission’s Action Plan for Grids tasked ACER and the Council of European Energy Regulators (CEER) with providing guidance on electricity distribution planning.

This guidance provides practical recommendations to help national distribution grid operators align with Europe’s decarbonisation goals and turn grid development into a driver, not a barrier, of the clean energy transition. By promoting more coordinated and inclusive planning, the guidance supports the EU Affordable Energy Action Plan, helping ensure the shift to clean electricity is not only sustainable and secure, but also fair and affordable for all Europeans.

Why grid planning needs a rethink

Distribution networks link homes, businesses and renewables to the wider power grid. Yet most were built for one-way power flows, not today’s decentralised, more flexible generation and fast-growing demand for electricity.

As electrification and renewable growth accelerates, so do the risks of grid bottlenecks and infrastructure development delays. That’s why EU law requires distribution system operators to publish distribution network development plans to outline medium and long-term flexibility needs and investments planned for the next 5-10 years so that the full potential of renewables can be integrated.

What are the key recommendations?

- Look ahead: Plan at least 10 years ahead and adopt a proactive approach to avoid grid bottlenecks and enable timely investments.

- Holistic approach: For strategic and efficient results, base electricity grid planning on three pillars: scenario development, network needs assessment and project identification.

- Balance infrastructure and flexibility: Address flexibility needs cost-effectively and ensure national distribution plans provide the necessary input for EU-wide flexibility needs assessment methodology (adopted by ACER today).

- Enhance transparency and public trust: Improve stakeholder engagement through structured publication, open consultations and inclusive communication practices.

- Coordinate: Strengthen cooperation among other system operators and align with broader spatial and sectoral planning to ensure system-wide consistency and efficiency.

- Regulatory oversight: National regulators should scrutinise distribution network development, including monitoring the implementation of plans.

ACER approves EU-wide methodology to assess national electricity flexibility needs

ACER approves EU-wide methodology to assess national electricity flexibility needs

What is it about?

In a further step towards Europe’s clean energy transition, ACER approves the methodology to be used nationally for identifying non-fossil flexibility needs. This is an important step in developing a common European basis for integrating more renewable energy into the electricity grid and meeting the EU’s decarbonisation targets. This ACER decision directly supports the EU’s Clean Industrial Deal by laying the groundwork for a more resilient electricity system that can power a competitive, low-carbon economy.

The flexibility needs assessment methodology (FNAM), developed by the European Network for Transmission System Operators for Electricity (ENTSO-E) and the EU Distribution System Operators Entity (EU DSO Entity), and approved by ACER, will guide Member States' electricity network operators in identifying how much clean and flexible energy their country needs to handle the variability of demand and supply in their power system.

What is power system flexibility and why does it matter?

Clean flexibility is the energy system’s ability to adapt quickly to changes in electricity supply and demand, without relying on fossil fuels. It enables:

- Demand response, storage or flexible generation to balance the grid in real time.

- Shifting renewable energy from periods of excess (e.g. windy nights) to times of high demand.

- Reducing renewables curtailment (wasting renewable energy when the grid can’t absorb it).

Unlocking clean flexibility will cut reliance on gas, enable energy transition in a cost -effective manner and help Member States deliver on the EU’s binding 2030 renewable targets (42.5%) and climate neutrality by 2050.

What is the purpose of the national flexibility needs methodology?

The methodology distinguishes between two main types of flexibility needs: network flexibility needs and system flexibility needs. Network flexibility reflects the flexibility needed to adjust for grid availability, whereas system flexibility refers to the ability of the electricity system to adjust both power generation and consumption in response to signals from the market.

The flexibility needs assessment methodology provides a harmonised approach for transmission and distribution system operators (TSOs and DSOs) in analysing the national flexibility needs in terms of:

- the data they must collect; and

- how they should assess their national electricity flexibility needs.

This harmonised and unified approach serves both national and EU-wide estimations of flexibility needs, with results feeding into reports that will identify how much flexibility is needed, where and at what cost.

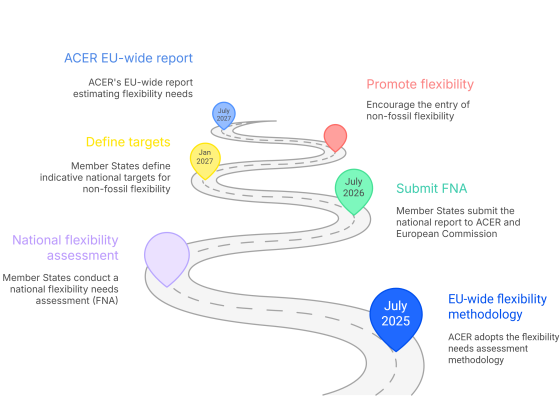

Each EU Member State shall now:

- Conduct a national flexibility needs assessment (FNA) using the new methodology.

- Submit it to ACER and the European Commission (by July 2026).

- Use the findings to define indicative national targets for non-fossil flexibility (by January 2027).

ACER will then publish an EU-wide report to estimate the flexibility needs including a set of recommendations on issues of cross-border relevance at EU level (July 2027).

What’s novel about this national electricity flexibility needs methodology?

This new methodology brings several important advancements to how Europe plans for flexibility, as it:

- Builds on existing studies, such as the European resource adequacy assessment (ERAA) and national resource adequacy assessments (NRAAs), to ensure consistency and prevent overlap.

- Covers distribution and transmission networks, enabling a full-system view of flexibility needs.

- Relies on distribution network development plans (DNDPs) to bring transparency to local flexibility gaps.

- Quantifies the amount of non-fossil flexibility needed per country to meet EU decarbonisation targets by identifying how much renewable energy can be cost-effectively shifted from periods of surplus to times of high demand – maximising clean energy use and reducing curtailment.

- Accounts for cross-border potential and the role of interconnections in meeting flexibility needs.

- Mandates the EU DSO Entity to issue a guidance, taking into account the ACER-CEER guidance on distribution network planning (issued today), to harmonise flexibility assessments across the EU and align with the EU Action Plan for Grids.

- Identifies regulatory and market barriers, echoing ACER’s No-regret actions to remove barriers to demand response.

This coordinated approach is essential to delivering a climate-neutral power system, ensuring renewables are fully used.

What’s next?

Member States now have 12 months to prepare their national flexibility assessments. These reports will become vital tools in shaping clean energy investment decisions, grid expansion and modernisation and designing EU policy to accelerate flexibility deployment across borders.

Learn more about flexibility and ACER's work in this area.

Have your say on Europe’s electricity capacity calculation regions

Have your say on Europe’s electricity capacity calculation regions

What is it about?

On 2 July 2025, electricity transmission system operators (TSOs) submitted to ACER their proposal to amend how capacity calculation regions (CCRs) are defined across Europe. ACER is now gathering stakeholder views to inform its assessment.

What are capacity calculation regions and why are they important?

CCRs are cross-border zones where neighbouring TSOs coordinate how much electricity can safely flow between them. This cooperation helps boost cross-border trade, prevent grid congestion and price spikes, and support a more secure, integrated European energy market.

There are currently nine CCRs in Europe: Nordic, Hansa, Core, Italy North, Central Europe (CE), Greece-Italy (GRIT), South-West Europe (SWE), Baltic and South-East Europe (SEE). They are key to ensuring efficient electricity use, especially as more countries and renewables come into play.

What is the amendment about?

The TSOs are proposing:

- adding three new CCRs to the South-East Europe region to cover borders with Energy Community countries (East-Central Europe (ECE), Italy-Montenegro (IT-ME) and Eastern Europe (EE)); and

- merging two existing regions (Core and Italy North) for several regional processes like intraday coordination and congestion management.

Your view matters!

ACER is assessing whether the TSOs’ proposal supports market integration, ensures efficient use of the grid and supports the well-functioning of the EU electricity market.

To make an informed decision, ACER is organising a public consultation from 24 July 2025 to 3 September 2025.

ACER aims to reach a decision by December 2025.

17 December 2025 update: With its Decision 10-2025, ACER has approved the proposed amendments.

Access to EU funding is the main driver for electricity and gas cross-border cost allocation decisions

Access to EU funding is the main driver for electricity and gas cross-border cost allocation decisions

What is it about?

Today, ACER publishes its fifth report on cross-border cost allocation (CBCA) decisions for electricity and gas infrastructure projects.

Covering 50 decisions made between 2014 and 2024, the report provides insights into how these decisions, issued by national regulators, determine the cost distribution of major cross-border projects and support project development.

How cross-border cost allocation works

Cross-border cost allocation is a mechanism designed to fairly distribute the investment costs of projects of common interest (PCIs) and projects of mutual interest (PMIs) among the countries involved. It aims to support project implementation, especially in cases where some countries would otherwise bear significantly higher costs than the benefits the project provides.

Project promoters submit investment requests to national regulatory authorities, who review them and issue CBCA decisions to determine how project costs should be shared among involved countries. This cost-sharing arrangement is required for projects to receive financial support through the Connecting Europe Facility (CEF), a major funding programme that supports the development of strategic infrastructure across Europe.

ACER monitors all submitted investment requests and decisions taken by national regulators and regularly reports on emerging trends.

What trends did ACER monitoring find?

ACER’s report shows:

- Fewer decisions overall: The number of CBCA decisions fell by around 65% in the second half of the monitoring period (2019-2024). This reflects a drop in the number of PCIs included in the EU project lists, partly due to completion of major energy infrastructure projects, but also the phase-out of natural gas and Brexit, which made several projects ineligible for inclusion in the PCI lists.

- Costs stay national in most cases: Member States usually agree to cover their own costs, as each one benefits sufficiently from the project.

- Connecting Europe Facility (CEF) is the key driver: Access to grants, not the need to share costs, is the main reason project promoters submit investment requests.

- No CBCA decisions yet for hydrogen: The sector is still in an early stage of development, but with hydrogen projects becoming eligible for inclusion in the PCI and PMI lists since 2023, CBCA decisions are expected in the coming years.

ACER monitoring reveals limited competition and untapped flexibility in EU retail energy markets

ACER monitoring reveals limited competition and untapped flexibility in EU retail energy markets

What is it about?

ACER’s 2025 retail energy country sheets offer a concise overview of the national electricity and gas markets across EU Member States and Norway. For the first time, the country sheets cover both sectors, presenting:

- market and competition metrics for electricity and gas;

- consumer trends (including contract types, contract switching rates and bill breakdown);

- progress towards enabling more flexible consumers (through smart meter roll-out, prosumer participation, deployment of electric vehicles and heat pumps, and biomethane production); and

- a high-level assessment highlighting each market’s strengths, weaknesses, opportunities and threats (SWOT analysis).

ACER has also updated its retail pricing dashboard, which shows monthly changes in household energy prices across EU Member States and Norway from January 2019 to June 2025.

What are the main findings in retail markets?

Electricity market

- Smart meters, a key enabler for demand-side flexibility, are largely in place across the EU, but roll-out levels vary among EU Member States and Norway. In half of EU Member States, deployment has reached 80%, while in 7, deployment remains below 20% (or no data was provided).

- Although 2024 saw an increased number of hours with low wholesale electricity prices (below €5/MWh), fixed price and/or regulated contracts still dominate in 15 Member States at the household level. This widespread uptake limits consumers’ exposure to real-time price signals, preventing cost savings and hindering more innovative and flexible contracts. The limited adoption of dynamic-price contracts suggests that demand-side flexibility potential remains untapped.

- In 21 Member States, prosumers account for between 1% and 10% of households. The highest shares are observed in Belgium (22%) and the Netherlands (30%).

Gas market

- 82% of residential energy consumption is used for space and water heating, underlining the importance of energy efficiency and building renovation strategies to support decarbonisation.

- A decline in gas demand has been recorded in 21 Member States since 2022, while biomethane production remains relatively low.

Market structure

- Both electricity and gas retail markets show moderate to high concentration across the EU, meaning a small number of suppliers hold a large share of the national market.

- 20 Member States either recorded low switching rates (below 10%) or did not provide data, indicating limited competition or low consumer engagement.

The country sheets complement ACER’s retail Monitoring Report (coming in November).

Retail prices: Latest trends from ACER’s dashboard

ACER’s retail pricing dashboard highlights the main trends in household electricity and gas prices.

Electricity prices across Europe stabilised by June 2025, ending the decline observed since early spring. Spain and Portugal recorded the sharpest monthly rises (+7% and +6%, respectively), followed by more moderate increases in Greece, the Netherlands, Italy and Austria. In contrast, prices declined in Norway (-7%), Estonia (-3%), and in Belgium, Latvia, Sweden and Lithuania (-2%). Most other countries recorded no change. On an annual basis, EU household electricity prices rose by approximately 3%.

Retail gas prices also remained largely stable, with minor monthly changes: Belgium and Portugal registered small increases (+1%), while Italy recorded the largest decrease (-4%), followed by France and Latvia (-2%), and the Netherlands, Estonia and Austria (-1%). While retail gas prices remained unchanged month-on-month in most Member States, retail offers were approximately 7% higher than those available during the same period last year.

What are the main trends in wholesale gas markets? Prices remained elevated year-on-year but showed little monthly change, despite volatility driven by global trade and security shocks. More information is available in ACER’s monitoring report on key developments in gas wholesale markets report, published today.

LNG surge and storage recovery improve Europe’s short-term gas outlook

LNG surge and storage recovery improve Europe’s short-term gas outlook

What is it about?

Published today, ACER’s latest report on key developments in European gas wholesale markets (Q2 2025) examines key trends in prices, supply and storage during the early months of the gas summer season. The analysis supports policy discussions on enhancing secure and competitively priced gas in Europe.

What trends did ACER monitoring find?

- Gas wholesale prices and volatility: Average wholesale gas prices fell by over 20% compared to Q1 2025, following a high-price winter. Price volatility eased, but remained relatively high, while regional price differences widened.

- LNG imports: Liquefied natural gas (LNG) imports rose by more than a third year-on-year, supported by competitive hub prices, slack demand in Asia and expanded US liquefaction capacity.

- Pipeline imports: No major changes were observed except for Russian supply to the EU, which dropped by 45% year-on-year following the expiry of transit contracts via Ukraine. Deliveries now reach the EU only through the TurkStream pipeline.

- Gas storage: Gas injections increased by 75 TWh year-on-year, helping to reduce the gap in storage levels compared to previous years. This follows a relatively tight end-of-winter, when stocks were lower than in 2023 and 2024.

Looking ahead

If current LNG inflows and storage injection levels continue, Europe is likely to enter winter with healthy reserves. Still, risks remain: extreme weather, disruptions to major supply sources, or geopolitical instability could alter the trajectory. On the supply side, the expected expansion of global LNG production in late 2025 and 2026 may help ease pressure.